Amazon Seller Central just grew up. The December 2025 update isn’t just a UI refresh or a “nice-to-have” redesign. It’s Amazon quietly telling sellers something important:

Manual selling is over.

Data-driven, AI-assisted, capital-efficient selling is the new baseline.

If you sell on Amazon seriously, whether you’re scaling a private label brand or managing a multi-country storefront,s this update directly affects:

- How fast you can operate

- How well you control cash flow

- How protected your brand is

- How competitive your ads and listings remain

Let’s break down what changed, why it matters, and how sellers can turn this into a real advantage, especially in a world where capital timing matters more than ever.

Seller Central Is Now a Command Center (Not a Menu System)

The first thing you’ll notice is the layout.

Amazon has officially moved away from the cluttered, vertical sidebar experience and replaced it with a horizontal, top-first command structure.

This matters more than it sounds.

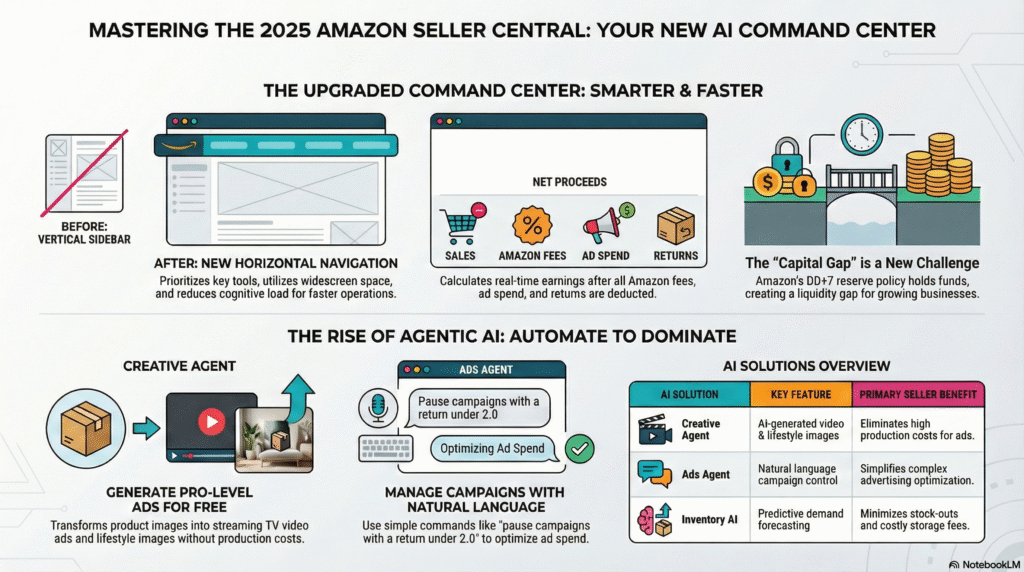

Why Amazon Went Horizontal

Most professional sellers today:

- Work on widescreen desktops

- Monitor multiple tools at once

- Switch between ads, inventory, payments, and compliance daily

The new layout keeps critical controls always visible while letting the content flow vertically, which is how the human brain naturally scans dashboards.

Result:

Less clicking, less hunting, fewer mistakes.

The New Global Header: Your Business Health at a Glance

At the top of Seller Central sits a blue navigation bar that now acts as your operational nerve center.

1. One-Click Marketplace Switching 🌍

If you sell in multiple regions (US, UK, AU, EU), you can now switch marketplaces instantly and see region-specific KPIs refresh in real time.

For global sellers, this is huge especially when comparing:

- Sales velocity by country

- Inventory pressure

- Cash inflows vs payouts, etc.

2. Account Health Is Now Front and Center ⚠️

Account Health has moved from a buried menu to the top-center of the dashboard.

That’s not accidental.

Amazon is making it very clear:

Compliance comes before growth.

Now you can spot policy risks before they freeze listings, delay payouts, or kill momentum.

Custom Dashboards: Finally Built for Teams, Not Just Solo Sellers

Seller Central now lets you customize your workspace based on role.

That means:

- Ops teams can focus on orders & inventory

- Marketing teams can prioritize ads & promotions

- Finance teams can center payments & profitability

This signals Amazon’s shift toward enterprise-style selling, even for mid-sized brands.

And beneath the header?

A new Action Bar that gives one-click access to high-frequency tasks like:

- Creating shipments

- Managing products

- Launching campaigns

Amazon just removed several layers of daily friction.

The Most Important Change: “Net Proceeds” at first glance

What Is Net Proceeds?

The at first glance Net Proceeds metric shows what you actually earn after:

- Referral fees

- FBA fees

- Storage costs

- Advertising spend

- Returns & refurbishments, etc

In other words:

This is the money you can realistically reinvest.

For sellers who scale fast, this single number is now more important than total revenue.

Why This Changes Financial Planning Completely

Amazon now allows sellers to optionally plug in:

- COGS

- Manufacturing costs

- Inbound freight

Once you do, Seller Central can estimate true net profit per SKU.

This exposes a hard truth many sellers avoid:

- Some “best sellers” quietly lose money

- High revenue doesn’t always mean healthy margins

For VePay funded sellers, this level of clarity helps:

- Size funding accurately

- Avoid over-financing weak SKUs

- Double down on efficient products

The DD+7 Reality: Visibility Improved, Cash Timing Didn’t

Even with better reporting, Amazon still holds your money.

Funds are released 7 days after delivery, not after the sale.

That creates a capital gap especially when:

- Inventory moves fast

- Ads scale aggressively

- Seasonal spikes hit

Seller Central now shows this gap clearly.

It does not solve it.

This is exactly where sellers feel the pinch and where funding decisions determine who scales and who stalls.

Where VePay Changes the Equation

This is exactly where VePay clients don’t have to worry.

While Amazon holds funds under the DD+7 policy, VePay steps in to release working capital immediately based on your real sales performance, account health, and marketplace data.

That means:

- You don’t wait for Amazon payouts to restock

- You don’t slow ads just because cash is temporarily locked

- You don’t miss seasonal demand due to timing issues

VePay funds sellers as soon as sales are confirmed, not days after delivery. So while Seller Central helps you see the gap more clearly, VePay helps you close it.

In practical terms, this allows VePay-backed sellers to:

- Maintain healthy inventory levels even during rapid sales velocity

- Keep AI-driven ad campaigns running without budget interruptions

- Scale confidently through peak events like Prime Day and Q4

In a marketplace where speed matters as much as strategy, access to capital becomes the real competitive advantage. VePay ensures that delayed payouts never become delayed growth.

Agentic AI (And It’s Not a Gimmick)

Amazon has moved beyond dashboards and into autonomous AI agents that don’t just analyze but act.

The Creative Agent 🎥

One of these is Creative Agent, a generative AI tool inside Amazon Ads’ Creative Studio that helps advertisers create professional-quality ad assets, including video, display, and audio content, using conversational guidance cutting down production time and cost significantly. advertising.amazon.com

Additionally, Amazon’s broader Seller Assistant with agentic AI can help sellers plan inventory actions, optimize operations, and generate strategic recommendations all while keeping human control central.

This AI can:

- Turn product images into professional video ads

- Generate lifestyle images without photoshoots

- Create ad-ready creatives for Prime Video & streaming platforms

What used to cost thousands now costs nothing but intent.

The Ads Agent 🤖

This is where things get serious.

You can now:

- Manage PPC using natural language

- Reallocate budgets automatically

- Pause underperforming campaigns instantly

You don’t need to be a data scientist anymore.

Amazon built one into Seller Central.

Complementing this is Ads Agent, which streamlines campaign setup and targeting. Sellers can describe their campaign goals in natural language or upload planning documents, and the AI agent suggests audiences, keywords, and structures that align with those goals. advertising.amazon.com

Amazon isn’t just showing more data anymore. It’s embedding agentic AI tools that go beyond analysis to assist sellers in action.

Inventory & Policy Tightening: 2026 Is About Discipline

While tools are getting smarter, policies are getting stricter.

End of Inventory Commingling

From March 2026:

- Brand owners get flexibility

- Resellers must label inventory individually

This protects brands, but increases operational precision requirements.

IPI Is Now a Growth Gatekeeper

Low IPI doesn’t just cost fees, it limits expansion.

Amazon now favors:

- Faster inventory turns

- Smaller, smarter restocks

- Clean catalog hygiene

This naturally pushes sellers toward frequent replenishment, not bulky bets.

Fees Are Rising (Quietly but Surely)

From January 2026:

- FBA fees increase modestly per unit

- Larger, heavier products feel it more

Amazon offsets this with:

- Stronger Low-Price FBA incentives

- Bigger SIPP discounts (ship in own packaging)

Sellers who optimize packaging and pricing survive.

Others bleed margins slowly.

Where VePay Fits in This New Amazon Economy

Amazon has given sellers:

- Better data

- Faster tools

- Smarter automation

What it hasn’t given is liquidity when you need it most.

VePay fills this gap by converting Amazon’s improved visibility of real sales, account health, and payout forecasts into immediate, Interest-free working capital, so sellers can restock, scale ads, and grow without waiting for Amazon’s payout cycle to catch up.

The Real Risk in 2026: Stock-Outs

Running out of inventory doesn’t just stop sales.

It kills rankings, momentum, and ad efficiency.

VePay’s role is simple:

- Bridge the Amazon payout delay

- Fund inventory before stock runs dry

- Enable sellers to fully use Amazon’s AI & ad tools

When Seller Central says you can scale, VePay makes sure you actually can.

The Seller Playbook for 2026

If you’re serious about winning on Amazon, the roadmap is clear:

✔ Use the new dashboard to run faster

✔ Let AI handle creatives and PPC

✔ Track Net Proceeds, not vanity sales

✔ Keep inventory moving, not aging

✔ Secure capital before Amazon releases it

Because in 2026, the gap between sellers who move fast and those who hesitate will only widen.

And the winners won’t just have better tools. They’ll have better timing and better capital behind them.